Published on March 5, 2020 by

It is a recurring theme in AI innovation – efficiency drives greater profitability for clients. That said, the ability of AI in terms of revenue generation is often overlooked. A recent study by MIT on global executives shows that companies around the world are increasingly looking to AI to create new sources of business value. The value of combining human intelligence with the efficiency and precision of technology is likely to create new avenues of growth.

Operational cost savings – Limited scope for traditional banks

Analysis of IDC data shows that ai and machine learning in banking technologies can improve the cost efficiency of banks and financial institutions by over 25% across IT operations. However, cost efficiency is always a function of core operational cost savings (net of infrastructure, maintenance and development costs) and revenue augmentation (new products, new channels, lower churn rates and higher revenue per customer), and in this case, hardly 5-7% of this efficiency gain can be attributed to core cost savings.

Banks often struggle to deal with increasing volumes of front-office queries and customer emails, as traditional customer-service models have limited economies of scale. The use of AI in such cases becomes a major factor when it comes to cost savings. One such AI tool is the conversational interface, virtual assistant or chatbot.

Today, conversational interfaces represent nearly 39% of AI use cases across the top 100 banks. However, our understanding, based on an analysis of commentary by CXOs in recent years on different platforms, suggests that banks are likely overestimating their cost savings through these very basic AI applications. Even AI-powered chatbots such as Bank of America’s Erica (virtual financial assistant), which is among the best banking chatbots, are still at an early stage of supervised learning through natural language processing (NLP) and predictive analytics.

Moreover, core operational cost saving opportunities for traditional banks are limited. Technologies are continuously evolving, and there is a risk of creating a perpetual cycle of legacy costs if banks do not adapt fast in the era of Open Banking [Payment Services Directive (PSD) 2]. In the meantime, nimble-footed and asset-light fintech companies and tech giants are capturing revenue share in the payments and cash management market. According to a recent report by Accenture, new companies (those that entered the market after 2005) have captured a banking-revenue share of around 4% in the US, 7% in the EU, 14% in the UK and 2% in Canada. This may seem slow but could have a multiplier effect following the Open Banking directive implemented in 2018, and traditional banks need to adapt fast.

New regulations and fierce competition have forced a change in strategy for most leading banks (early adopters of technology and AI) towards the revenue-augmentation side of the AI value chain. A study by Deloitte reveals that 60% of leading banks are now focusing on revenue enhancements.

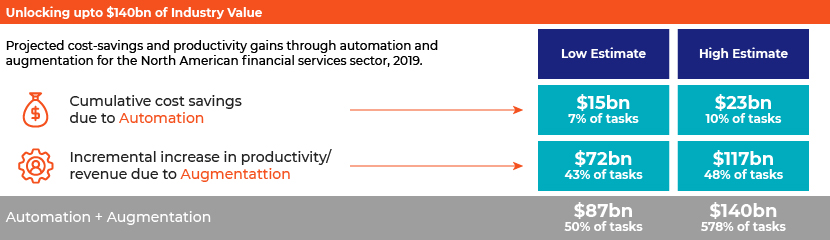

Revenue/productivity augmentation – Unlocking trapped value would do more than saving core costs

Banks should look at AI as a new factor of production. AI should be used as a human-capability enhancer rather than a mere replacement tool. By using AI, banks could free up a large number of staff hours spent on strategic work since, ultimately, 25% of non-routine tasks drive 85% of value creation. Banks could expect new revenue across product lines, an increase in the development of new products and improvements in income per product, volumes, customer acquisition and retention. According to a report by Accenture, 7-10% of tasks in the financial services space could be automated by 2025, while 43-48% could be augmented using technology.

Exhibit 1: Augmentation value-adds to outpace cumulative cost savings

Exhibit 1: Augmentation value-adds to outpace cumulative cost savings Source: Accenture report titled “Workforce 2025: Financial Services skills and roles”

Traditional banks have a significant advantage over new fintech players – access to financial data pertaining to millions of customers. This might change very soon under the new Open Banking directive, or PSD2. Banks need to act fast. A recent survey shows that two-thirds of banking customers are open to banks accessing their data if it ensures better, customised services.

Unlocking trapped value – Revenue saved is revenue earned

Compliance is a necessary evil for banks. A survey found that firms typically spend 4% of their total revenue on compliance, but this could rise to 10% by 2022. Advanced risk analytics scoring engines and real-time solutions would help banks detect transactions with potential compliance concerns more efficiently. In fact, some reports suggest that risk-related functions (compliance, risk management, and fraud and cybersecurity) made up 56% of all AI product offerings in banking in 2018. Fraud- and cybersecurity-related AI companies such as Feedzai raised more money than any other AI vendor in 2018-19.

Some leading UK-based banks are using AI and predictive analytics (such as from Personetics Technologies) to monitor customers’ transaction data and patterns in real time, which then provide personalised reminders for subscription payments and flags unusual spending. This has resulted in an estimated 5-7% increase in revenue per customer.

AI-augmented credit underwriting processes (for instance, ZestFinance underwriting loans for those who do not have a credit history) that use “alternative data” (digital footprints) are helping banks improve credit-risk modelling. Self-adapting AI (for instance, Smart Chaser by BNP and Katana by ING) is also helping big banks analyse big data for better trade processing and identifying investment opportunities.

Conclusion

The true potential of AI in banking still seems to be some distance away from being realised. Banks’ AI goals should look beyond cost reduction. Moreover, expectations around cost savings need to be in sync with reality. Banks need to understand the interplay between their processes, data, employees and AI. Rather than a replacement tool, AI could be used as an enhancing tool. Enhancing customers’ banking experience by augmenting employees’ scope should be the way forward.

Acuity Knowledge Partners, with its deep understanding of global banking services, and its emerging data analytics tools and AI technologies, is helping its global clients evaluate the impact of technology on banks’/companies’ profitability by understanding new-age fintech services and analysing the AI marketplace.

Sources

https://sloanreview.mit.edu/projects/artificial-intelligence-in-business-gets-real/

https://www.americanbanker.com/opinion/cost-savings-from-regtech-wont-come-overnight

https://www.accenture.com/in-en/insights/financial-services/workforce-2025-skills-roles-future

https://emerj.com/ai-sector-overviews/ai-in-banking-analysis/

https://www.consultancy.uk/news/23371/ai-can-boost-financial-services-revenue-by-140-billion

https://www.oliverwyman.com/content/dam/oliver-wyman/v2/publications/2019/dec/ai-app-in-fs.pdf

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox